When it comes to securing online accounts from frauds and scams, KYC proves to be a strong option. Know your customer is a way of customer identification against fake identities. KYC authentication means giving access to customers by confirming their identities.

Why is KYC Authentication Needed for Financial Institutions?

ID verification acts as a strong wall against crimes like international money laundering and funding to terrorist organizations. Countries and businesses have suffered from money laundering and identity theft. Criminals join the financial channels posing as legitimate customers. Then they disrupt the business operations through their illegal activities.

For example, a fraudster signs up on social media platforms by giving stolen or fake details and photographs. Then he sends requests to other users and might message them. There they target kids and ask them for their passwords or parents’ credit card numbers. Kids consider that users are authentic, and their friend gives them information. Then credit card fraud initiates through this. In case the criminal has stolen some other person’s identity, he can directly ask for payment from the actual person’s friends.

If the targeted channel is giving financial services, the results of the crimes are much more serious. If a fraudster opens an online bank account or registers on a digital payment transfer channel, he can launder funds on it. Money laundering needs financial channels for layering illicit funds. Digital payment transfer like mobile apps can assist in this if it does not have KYC authentication security.

Financial crimes are more sophisticated now, as criminals have developed ways that have low vulnerability. Now, a criminal no longer needs to steal cash from a person physically. He can simply access an online bank account by cracking the password (through phishing). This has a low risk because of the anonymity of the users.

KYC Requirements for Banks

They know your customer regulations for banks are becoming strict with the time. The reason is financial institutions are at a greater risk of financial crimes. Local and global law enforcers can also penalize or blacklist banks for not having KYC authentication security protocols. Between 2008 and 2018, financial businesses faced fines worth $26 billion because of non-compliance with AML, KYC, and CFT regulations.

Below are the KYC requirements for Banks.

- Every onboarding customer must be verified through his identity documents

- Existing customers should be re-verified after regular intervals i.e. low-risk after five years and high-risk after one year

- If there is a hazard that a customer is somehow associated with a crime, he must be verified through enhanced due diligence (EDD)

- To combat money laundering, the names of customers should be screened against global criminal and PEP lists

- The activity of customers like, to whom they send funds and what is the amount, is needed to be monitored. If he sends money to a money launderer or a terrorist organization, the activity should be reported by a process known as SAR (Suspicious Activity Reporting)

- Background screening is required to perform on all customers and their transaction

How KYC is Conducted?

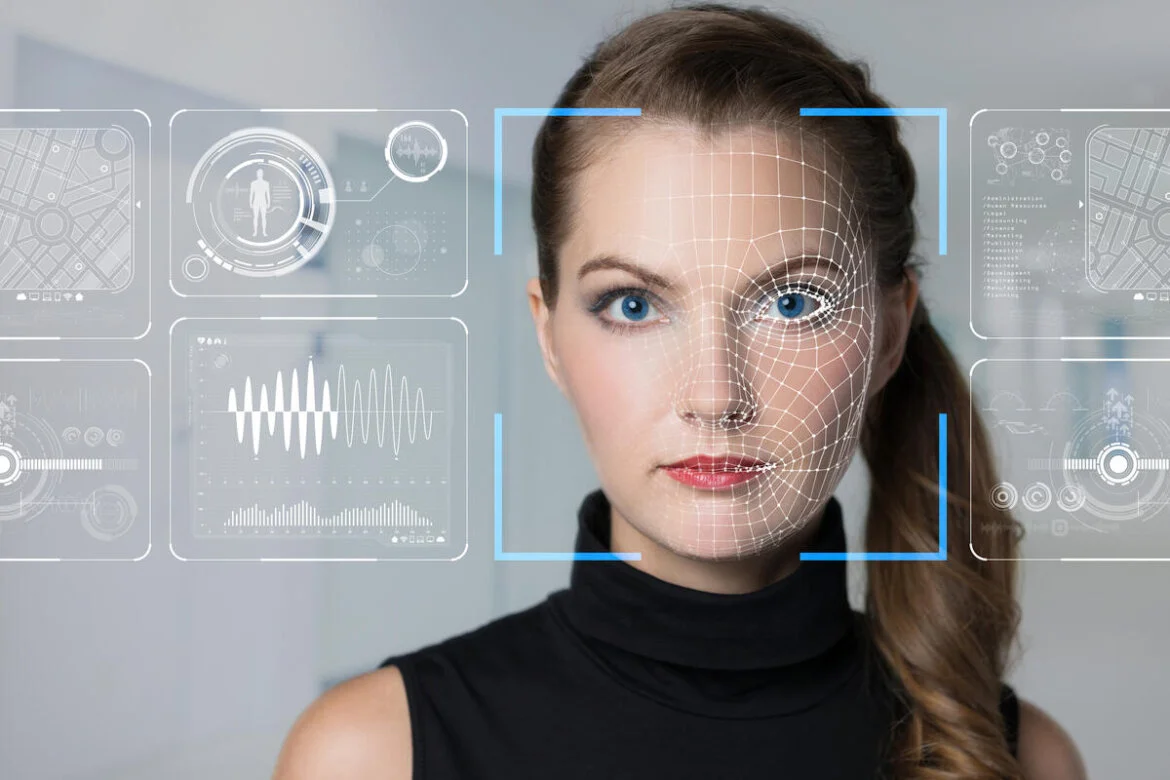

The users just have to type their personal information, upload images of ID documents, and capture their selfies. All the checks are performed by the software, here we will discuss some of them.

- Document Verification: The authenticity of the uploaded image is marked, and it is ratified that the document is legitimate. It is confirmed that the ID is approved by some government authority or not

- Facial Recognition: The selfie and photo on ID is compared if they show a resemblance, the user is verified

- Data Extraction and Validation: The details from the image are captured using OCR technology. Then this information is validated with the user typed information

Some solutions are also providing video KYC services in which the verification is performed through a live video interview. This is quicker and safe than the regular KYC process. Also, the video can be recorded for future proof.

Wrapping it Up

Financial services providers, especially banks, should acquire a KYC authentication solution. This can be integrated on mobile apps and websites as well through APIs. It will safeguard their channels from financial crimes and illegal funds transfer.